- Solutions

- Foundational Coverage

An all-in-one security program that provides comprehensive protection for businesses of any size or maturity.

Advantages

Proactive Security, Efficient Approach, Value Beyond Security

Features

24/7 Level 2+ SOC Support, Proactive Posture Enhancement, Malware and Non-malware Response, Fully Curated Tech Stack, Live Security Training

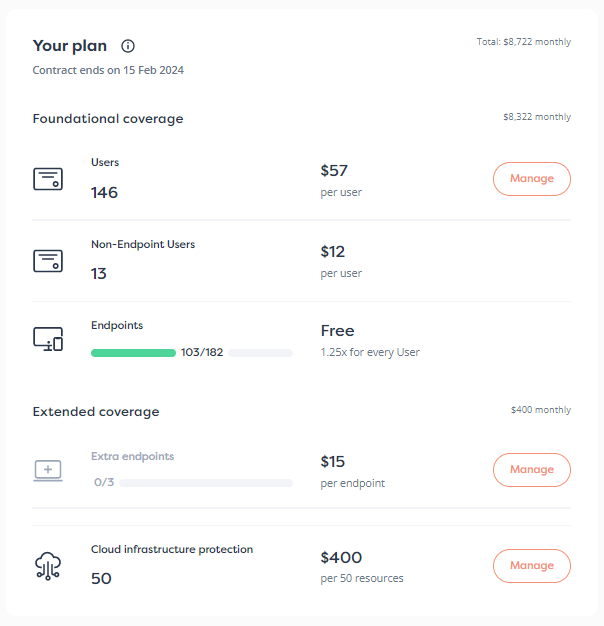

Pricing

All-inclusive user-based subscription, includes software licenses

- MDR++

Begin your journey towards enhanced cybersecurity resilience with our fully managed detection and response services.

Advantages

Fast Start for Managed Detection & Response (MDR) and SIEM

Features

24/7 Level 2+ SOC Support, Live Security Training

Pricing

Based on the number of devices

- Security Monitoring

Experience better security monitoring, reimagined for the latest threats.

Advantages

24/7 monitoring and log ingestion delivers you round-the-clock security. We deliver actionable items based on our user-based analytics that enable you to quickly respond to events.

Features

Support for over 500 technologies, 1-year log retention, and advanced analytics including user behavioral analysis.

Pricing

$1000/month for 100 EPS (events per second).

- Extended Coverage

Add-ons that can enhance your protection or meet compliance requirements based on the specific needs of your organization.

Advantages

Flexibility to incorporate extra protection for different environments

Features

Cloud Visibility & Protection, Application Layer Encryption, API Protection and Visibility, Security Consulting and IR Retainers

Pricing

Incorporated into subscription payment

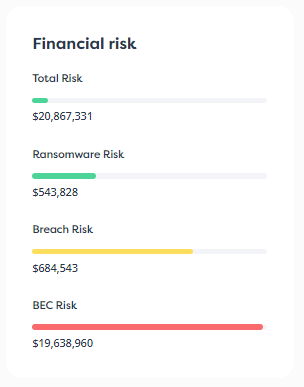

- Cyber Insurance+ Program

Your guaranteed path towards fast and affordable cyber insurance, available to all Foundational Coverage customers.

Advantages

Expedited Cyber Insurance Approvals, Significant Policy Discounts

Features

- Insurance provided by A+ AM Best rated insurance company

- Free access to cyber risk management platform

- Custom incident response vendors

- Foundational Coverage

- Who we help

- From Scratch

This service is tailored for companies seeking dependable security, streamlined implementation, and hassle-free progress, ideal for startups, SMBs, and growing organizations.

Simplify Complex Beginnings:

For companies that want security that they can depend on but don’t know where to start

All-Inclusive Cyber Resilience:

Super quick implementation – up and running in 30 days or less

Hassle-Free Security Journey:

For startups, SMBs, and organizations primed to see accelerated growth.

- Scaling Up

This service suits companies aiming to enhance existing cybersecurity, seamlessly integrate crucial tools, and achieve enterprise-level security and compliance.

Effortless Scaling:

For companies who have some cyber in place, but know they’ve got some gaps and want to upgrade ASAP

Streamlined Integration:

Seamlessly incorporate essential tools with Foundational Coverage and unlock dedicated security resources that deliver 24/7 management, detection, and response

Complete Assurance:

For organizations looking to win enterprise customers and meet compliance standards

- Overburdened

This service caters to companies seeking strategic efficiency, streamlined vendor management, and trusted support, particularly suited for enterprise organizations with established security frameworks.

Outsourced Expertise:

For companies who already have a solid security stack in place, but want to be more strategic and save time, money, and resources

Unburdened Focus:

Reduce the number of vendors you deal with to 1 and free up your current security resources to focus on what’s important

Trusted Support:

For enterprise organizations or those that already have a mature security posture, but need that extra support and expertise

- From Scratch

- Pricing

- Resources

Connect

-

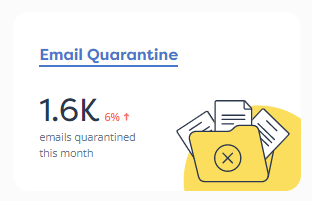

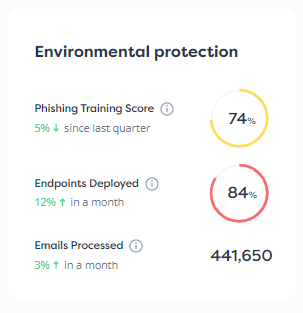

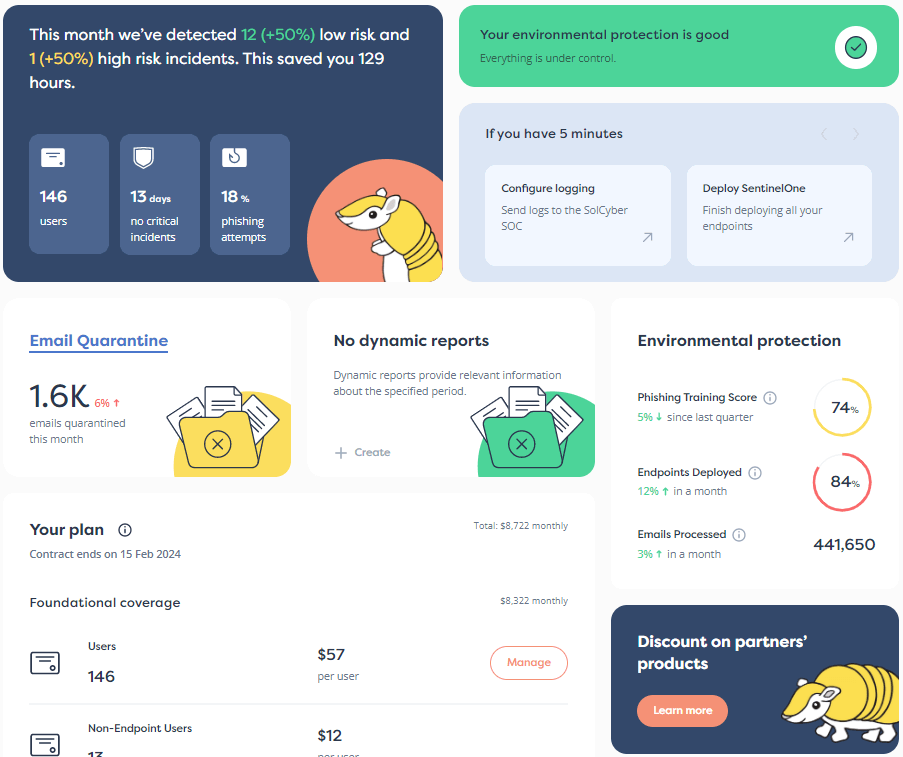

Customer portal

Check out a preview of our Customer Portal. It's actually GOOD.

-

About SolCyber

Who we are and what our mission is.

-

Careers

We want polite and caring people willing to tackle any problem and be part of something that’s, frankly, not the norm.

-

Partnerships

Find out about our "Howdy Partner" Program.

-

Contact

Contact us with any questions!

-

Customer portal

Learn

-

Case Studies

How we help clients achieve strong cyber resilience and peace of mind.

-

Blog

The latest cybersecurity trends and best practices from the SolCyber team.

-

Tales From An Armadillo

Series of true stories about our clients in comic format.

-

News

The latest cybersecurity news.

-

Downloads

Your go-to source for the latest SolCyber content: ebooks, infographics, datasheets, videos.

-

Case Studies

- Connect

- Learn